Startup Pitfalls

Copyright© Miklos Szegedi, 2022.

It has been three years since I started my business. I wanted to reiterate on my successes and failures to help others on their own trails.

I was able to fund my own business selling share incentives I had in Cloudera, after I was laid off. The company had significant successes that year, and I was able to invest it with good returns and some fixed income.

Obviously, I had my own investor, my wife. She was my Son Masayoshi, checking whether we are heading to the right direction.

My original plan was to create an enterprise software startup like Nutanix. I am glad that I started an MBA. What I studied convinced me that building on share of an IT budget is a wrong approach. I can try to push for a share of that market, but it is an expensive investment to disrupt and compete in marketing.

I rather chose to do research first. I built on my existing knowledge of the codec industry. I started patenting a codec that is not so effective, but it gives an edge to gaming developers, graphics vendors, display vendors, camera vendors, etc. They can out-compete their rivals in costs, when everybody reached their limits. Patenting takes time, and it is a fixed cost for a while, but it pays off in the long run. Research for and edge differentiator has to be started early. However, it reduces flexibility and revenue early.

I also missed some education, that I should have done when I came to the US. I finished an MBA that builds trust with locals. It also shaped my mindset that I am more of an investor than engineer. I can now opt to be a founder instead of a tech lead anywhere.

Lots of economic research eventually paid off. I realized that disruption is expensive. It is better to model Silicon Valley as layers of lava of new tech. It is cheaper to add to it rather than to break through of rocks. Disruption takes money, and it is more like a race for a share of fixed resources that requires allies. Cloudera was similar with significant investment from Intel, selling the hardware that Big Data needed.

This means that your customers are low paid, and you want to increase their GDP impact. The simulated existing economy reached its limits for those startups. You need to go back fourty, or even sixty years when Intel, Apple, or Microsoft were founded, and revisit the tech decisions they made.

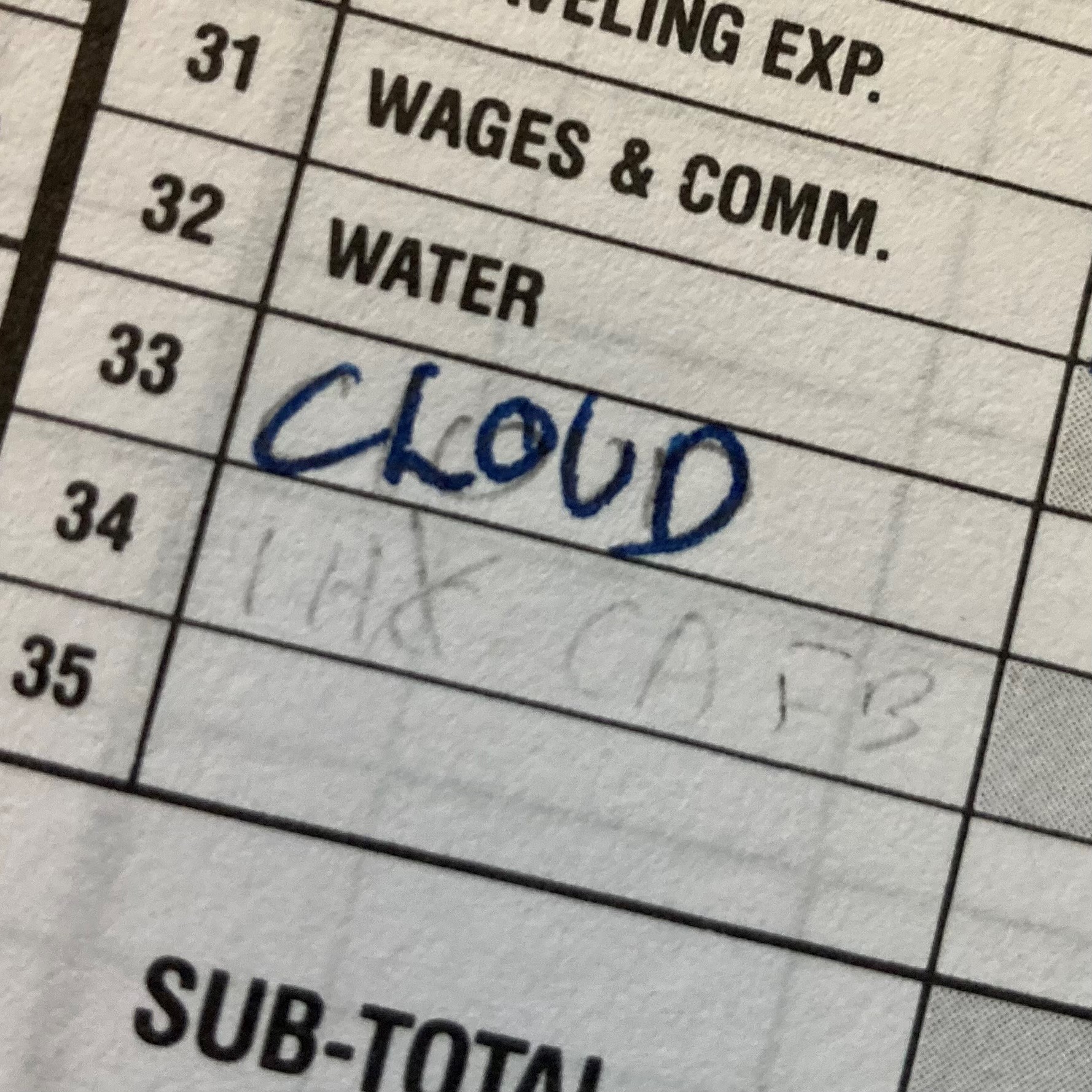

I bought a Dome accounting book in Walmart, to compare the opportunity costs. You can see the iconic picture booking my cloud costs in paper in 2022. I learned quickly that I am a bad calculator, and Excel and Oracle Netsuite indeed pays off. We can scale companies better with tech.

Security is an issue. The author believes that any political and economic changes in the past thirty years are due to computers and internet. It is not politicians, it is not special interests, it is not religion. It is all about communicating more and having access to the world. Suddenly we could be reached from any country, and we were compared to all cultures. Look at what happened at Twitter in 2022, and you see what it is about.

We had to learn empathy, and we had to set our own boundaries. I learned that commercial routers have limitations. I bought from multiple vendors and lost access to the internet in a few days after setup. I set up my own Rancher Linux server as a firewall to mach the security of Microsoft to be able to do independent decisions. Those without experience to do that step are behind my company in opportunity.

I also learned that sophisticated malware, and marketing tech called feature flags can make code very elastic. High frequency sound and radiation can have some impact on mood and decisions. You need to secure your stuff. Ransomware can let you going and suddenly revert your changes. It can build earlier versions. It can slow you down ignoring keyboard input. Machine learning is great but it eventually learns grammatical mistakes, so it becomes a rough advisor.

One big mistake of engineers is that they start coding. Luckily, I did some but not much, which was eventually became salvage. The good software is lean, preferably no-code. Every day is a day to ship. Tech should help to make a slide in thirty seconds. Tech should help to design user interface by example. No-code has great future. Outsourcing is great, but I suggest using it for refinement to retain your differentiator.

There is a great reference at the end of Harvard cost-cutting strategy. When you do a lean startup you need to be like a bank. Rate matching reduces risks by assigning investment to savings with similar risks. Fixed income is great to support your mortgage or health insurance. Having less income helped to try all the options available in the United States. We had to change health insurance providers to get a service quality we pay for. It is good to have contracting options to generate revenue from servicing, but servicing does not scale. You may get a margin from a project, but eventually you have to have a product with positive income. A business generates cash flow. It is not capital gains, it is not software to resell, it needs to be cash flow. Yes, Amazon is a counter example. However, there is just one Amazon, and their main differentiator is great show business. They are transparent and they have good press.

I also learned about different funding strategies. Choose your business conduct. I eventually want to do business in payment services, or health insurance. That means I must be traditional. SAFEs are debt funding options that convert to preferred equity. I opted out. I was actually offered two million dollars. However, the Omicron strain of COVID just appeared. I wanted to make sure I can finish the project, while paying the potential healthcare and disability obligations to employees. I could not collect as many investors I expected to match the risks, so I declined.

My business conduct became this. Debt is a repayment obligation. Debt like SAFE has to be secured with a liquid asset, insurance or collateral. If you do not have that, you offer equity. If the equity offers leaves you with low cash flow, you do not do business. You need to do a minimum viable product first to do SAFE. Check the opportunity cost of working for a tech company doing the same project and set your equity compensation accordingly. If you earned $200k making a lidar with a team of five, you probably want to seek for $1M, and a share of 20% or a $200k base salary.

You need to set your priorities. I decided to focus on family and be there when they need me during the pandemic. A self funded startup helps with this. Health helps, so I did an hour of exercise every day. I am a fan of psychology having an ancestry from Austria-Hungary. Doing family first, and reading literature as well cleans up the mind. It makes you remember and emotionally relate to any memory of your life. This generates a sustainable brain performance that helps to be a founder or founding team member. You will become ultra liberal understanding the behavior of your customer base, rather than very liberal trying to teach them your ways. Also, reduce complexity. The FTX issue is a good example.

I was lucky to simulate many of these mistakes without spending somebody else’s money. My wife was my Son Masayoshi, the investor scrutiny. My conclusions are the following points.

- Every day is a day to ship.

- You have to cut under cheap tech. Titles, experience do not help to be expensive.

- You can ask more if you add more value, or lower risk.

- Once some revenue comes in, the data helps to convince and assess investments and returns.

- I like the idea of two companies. One for services with limited liability, the other one is for all projects with investors.

- A DBA format helps to keep a company together reducing risks.

- Do not disrupt but extend.

This last one is important. Tech companies create new equipment like a bulldozer. The economy accepts spending 4% of resources on them. This is because they allow us to build more affordable new trailer factories. Eventually the benefactors sell trailers benefiting everybody in a similar fashion, but shared funds creates the need to make bulldozers cheaper. Tech unit costs and revenue will always decline compared to GDP.

The way industries work is that old companies coexist with their original clients. New companies build their own client base, and they grow together, if they are successful. IBM and Intel gave space to Microsoft and Apple. The Internet of Comcast and AT&T gave space to Google, and Amazon. Apple, Samsung, and Nokia gave space to Facebook, and Twitter. Multi-core processors gave space to Amazon Web Services, Azure, Zoom, and Salesforce.

The next innovation in hardware will bring in more software value. Tech distributors sell service offerings for an annual recurring revenue. There are many of these since companies compete, and they do not want to share vendors. They can compete in design, and probably there won’t be a new Steve Jobs, but batches of celebrities will give their user interface ideas and name to vendors like Nike.

Distributors of these offerings use security tailored technology providers. Norton, Kaspersky, McAfee all gave their names to their brands promoting security. The future antivirus vendor will probably ship the operating system bundled with their changes. Different Linux distributions are similar security promises. They are also architecture assurances of tech mindsets supporting security and privacy.

Operating systems will probably be more coupled to hardware. They need to be open, shared by multiple platform vendors. This makes them liquid, so the products relying on them can be a collateral for corporate debt. Assets that can be swapped with other vendors appeal to investors.

Monopolistic hardware providers will likely scale back because of this reason. Their clients won’t be able to compete with lower risk and lower cost users of open technologies. The risk of a monopolistic vendor cuts off supplies increases required returns. The risk of few nanometers tech having backdoors or errors also increase required returns. I trust my Dome book for accounting more than anything else.

As the Harvard Business Review article in the reference section says: “Fix the roof while the sun is shining.” Liquid assets appeal to many investors. This is the success story of ARM processors. Companies get liberty in their business. Independent decision-making eventually reduces risks increasing returns for investors and employees.

Reference: https://hbr.org/2017/03/how-to-cut-costs-more-strategically