Risk-Free Rates

Economics research that relies on the statistics of securities deals with risk-free rates. These are the rates that investors require within every single asset as a minimum.

What generates risk-free rates?

Copyright© Schmied Enterprises LLC, 2025.

Link of the day.

Offer page for a 'Realistic Bunny Robot Toy' from Fanyil. Here.

Link of the day.

One Steuart Lane - Luxury waterfront residences in San Francisco. Here.

Link of the day.

Online tool to check website responsive design across different devices. Here.

Link of the day.

Chime - Financial technology company offering online banking services. Here.

These rates are risk-driven. If rates and risks diverge, investment becomes a no-brainer game for high-value individuals. Inequality increases until the assets that fuel them disappear, and rates return back to risks due to low demand. This is what foreign currency arbitrageurs do.

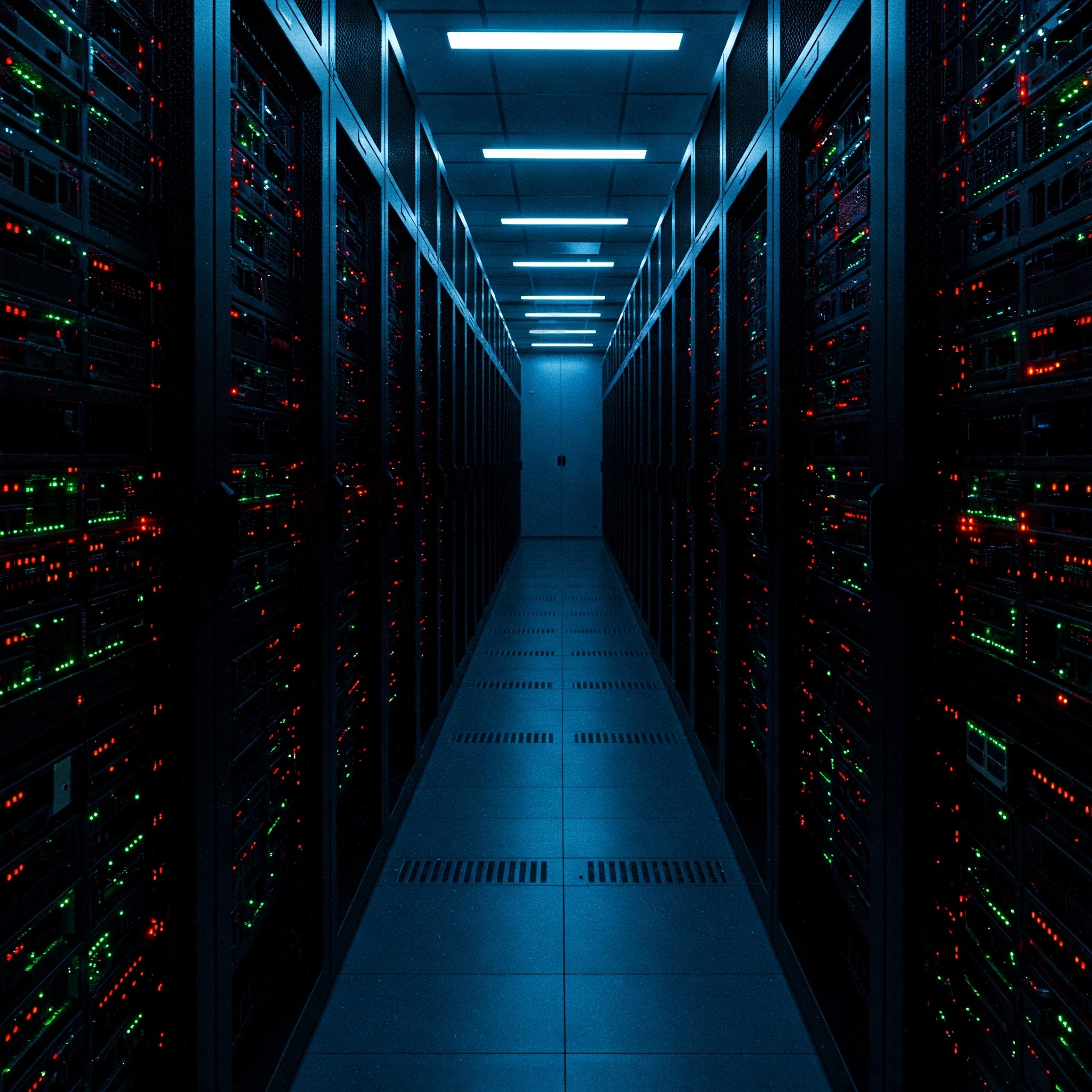

The first way to describe risk-free rates is with cloud providers. These companies fill up vast data centers with GPUs for artificial intelligence. Prices and user experience vary. Customers will choose which one to rent, or not rent at all and keep the money for the next period. The percentage of these remaining idle data center nodes compared to the used ones are the risk-free rate for the investors of cloud companies. We do not know in advance which data centers will be chosen, which won't. This risk comes with liquidity.

If investors decide to build fewer data centers attempting to eliminate the risk-free rates, customers still have a liquidity choice applying comparable rates to the smaller demand. This effectively makes investors another player in the game generating the risk-free rates.

Overnight federal funds rates generally follow the risk-free rates. This is required to keep banks liquid with a variance of wire transfer requests.

Investors use these rates to collect the interest in exchange for deferring their demand. Their utility value is the amount of GPUs used, like playing games. If they defer usage, their happiness will be lower. The bank's base interest rates compensate them by allowing them to buy more GPUs later from the money. The idle time is reflected in the discounted present value of their assets.

Oftentimes risk-free rates are just hypothetical. Idle GPUs mean less model training that needs to start later. No assets match the money at hand, meaning inflation will match smaller model quality and value to more money available.

Part of the risk-free rate is reflected in the loss in assets and inflation as a result. Some other part is the price of liquidity and better-quality products as a result. The rate is also comparable to the average time a person spends idle (shool, unemployment, retirement) in their lifetime, as it adds up to the GDP. Free markets are still better than fixed production, when you can only buy rice and nothing else.